Agile-IQ SEARCH - Career Advice & Tips

Senior Executive Interview - Due Diligence Checklist

Strategic Approach to Using This Framework:

This comprehensive question set is designed for senior candidates evaluating roles in technology, finance, or insurance. You won’t ask all questions in a single conversation - instead, distribute them strategically across multiple interviews with different stakeholders. Customize based on your specific situation: private vs public company, transformation vs optimization role, and industry focus.

Business Strategy and Market Position

Understanding Competitive Dynamics and Sustainability:

- Market Evolution Assessment: “How has your market position and competitive landscape evolved over the past 3-5 years, and what specific metrics demonstrate sustainable competitive advantages?”

- Revenue Model Validation: “Can you walk me through your unit economics - specifically customer acquisition costs versus lifetime value, gross margins, and how these have trended over the past 24 months?”

- Competitive Differentiation: “Who are your top three competitors, and where do you consistently win or lose against them? What would it take for a new entrant to displace you?”

- External Threat Assessment: “What external forces - regulatory changes, technological disruption, macroeconomic shifts, or new competitive entrants - represent the biggest threats to your business model during the next three years?”

- Industry-Specific Performance Metrics:

- For Insurance: “What is your combined ratio trend over the past eight quarters, and what percentage of profitability depends on underwriting versus investment income?”

- For Technology: “What percentage of growth is organic versus acquisition-driven, and how sustainable is your current growth rate given market conditions?”

Financial Health and Sustainability

Comprehensive Financial Due Diligence:

- Financial Transparency: “Can I review recent board decks or financial summaries to understand actual performance versus projections and see how you communicate results to stakeholders?”

- Cash Position and Runway: “What is your current cash position, monthly burn rate, and exactly how many months of runway exist before additional funding is required under current assumptions?”

- Capital Structure Analysis: “Can you explain your capitalization table, including any liquidation preferences, debt covenants, or investor rights that might affect future decisions or my equity value?”

- Revenue Concentration and Stability: “What percentage of revenue comes from your top five customers, and how have those relationships evolved over time?”

- Forward-Looking Financial Health: “What are your revenue and profitability projections for the next 18 months, and what key assumptions underpin those forecasts?”

Role Definition and Authority Structure

Clarifying Expectations and Decision Rights:

- Role Context and Mandate: “Is this a ‘peace-time’ role focused on optimizing existing systems, or a ‘war-time’ role requiring transformation of struggling operations? What is my specific mandate for the first 180 days?”

- Decision Authority Boundaries: “What decisions can I make independently with my allocated budget and resources, and what requires CEO, executive team, or board approval?”

- Predecessor Analysis: “Why is this position currently open? If my predecessor left or was terminated, what were the specific circumstances, and what lessons were learned?”

- Success Metrics and Constraints: “How will my performance be measured, and what organizational constraints or ‘sacred cows’ might limit my ability to execute effectively?”

- Resource Allocation: “What budget, headcount, and operational resources are ring-fenced for this role, and how much flexibility exists to reallocate resources based on priorities?”

Technology Infrastructure and Operational Reality

Assessing Technical Foundation and Execution Capability:

- Technology Stack Assessment: “What represents the biggest existential risk or single point of failure in your current technology infrastructure?”

- Innovation Capacity: “What percentage of your technology budget is allocated to maintenance versus new development, and how has this ratio changed over the past two years?”

- Legacy System Dependencies: “What are the three oldest or most problematic systems still in production, and what realistic timeline exists for modernizing or replacing them?”

- Data Governance Maturity: “How would you characterize your data governance, quality, and accessibility? Are we truly ready for advanced analytics and AI implementation?”

- Digital Transformation Reality: “What major technology initiatives have failed in the past three years, what caused those failures, and how has the organization learned from them?”

Risk, Compliance and Regulatory Landscape

Understanding Legal and Regulatory Exposure:

- Current Regulatory Status: “Are there any open consent orders, matters requiring attention from regulators, active investigations, or material litigation I should understand?”

- Regulatory Relationship Quality: “How would you characterize relationships with primary regulators - when was the last examination, what were key findings, and how collaborative versus adversarial is the dynamic?”

- Compliance Culture Assessment: “How does compliance function within the organization - as a strategic partner helping enable business objectives, or primarily as a risk-averse control function?”

- Future Regulatory Challenges: “What regulatory changes on the horizon concern you most, and how are you preparing for them?”

- Personal Liability Considerations: “What director and officer insurance coverage exists, and have there been any recent claims or concerns about personal liability for executives?”

Leadership Dynamics and Culture

Evaluating Team Effectiveness and Organizational Health:

- Executive Team Dynamics: “How does the executive team handle disagreements and make difficult decisions? Can you provide a specific recent example of conflict resolution?”

- CEO Leadership Assessment: “How would you describe the CEO’s leadership style, decision-making approach, and communication preferences, particularly during challenging periods?”

- Cultural Reality Check: “What behaviors actually get rewarded here through promotions, compensation, and recognition, beyond the stated company values?”

- Change Management Capability: “When was the last significant strategic pivot, what drove it, and how effectively was it communicated and executed throughout the organization?”

- Board Governance Quality: “How engaged is the board in strategy and oversight? Who are the key board members, and what expertise and perspectives do they bring?”

Compensation and Financial Terms

Comprehensive Compensation Analysis:

- Total Compensation Structure: “Can you provide detailed breakdown of base salary, annual bonus targets, long-term incentives, and benefits, including how variable compensation has performed historically?”

- Performance Metrics Realism: “What specific KPIs drive my bonus and long-term incentives, and what percentage of executives at my level achieved target compensation over the past three years?”

- Equity Valuation and Liquidity: “For equity compensation, what is the current valuation methodology, vesting schedule, and realistic timeline for liquidity events?”

- Risk Protection: “What severance provisions, change-in-control protections, and restrictive covenant limitations exist for executives at my level?”

Strategic Direction and Exit Planning

Understanding Long-Term Trajectory:

- Exit Strategy Alignment: “What does a successful outcome look like for founders and investors - IPO, strategic acquisition, private equity transaction, or remaining private indefinitely?”

- Strategic Vision Execution: “Where do you realistically expect the company to be in three years regarding size, market position, and organizational maturity?”

- Value Creation Drivers: “What are the key value creation milestones that must be achieved to reach your strategic objectives, and what are the biggest risks to achieving them?”

Validation and Reference Checks

External Perspective Gathering:

- Stakeholder Conversations: “Can I speak with a peer executive, a key business stakeholder who will depend on my success, and a board member to understand different perspectives on challenges and opportunities?”

- Former Employee Insights: “Would you be comfortable connecting me with former executives or employees who left in the past year to provide unfiltered perspective on the organization?”

- Customer or Partner Validation: “Can I speak with key customers or partners to understand their experience working with the company and their view of your market position?”

Red Flag Detection and Final Validation

Critical Probing Questions:

- Unvarnished Reality: “What keeps you awake at night about this business, and what am I not seeing or hearing that could significantly impact my success in this role?”

- Decision Regret Analysis: “If you could change one major decision made in the past year, what would it be and why?”

- Failure Mode Assessment: “What would make this role unsuccessful, and how often has that happened historically with previous role holders?”

- Honest Disqualification: “Given what you know about the challenges and constraints of this role, why should I not take this position?”

- Timeline and Urgency Validation: “What is driving the urgency to fill this role, and what happens if it remains open longer than expected?”

Implementation Strategy for Maximum Effectiveness

Distributing Questions Strategically:

Organize your question deployment across multiple conversations with different stakeholders. Use 8-12 questions per interview session, focusing on areas most relevant to each interviewer’s expertise and perspective. Save the most probing questions for final conversations when you have established rapport and demonstrated serious interest.

Industry-Specific Customization:

For technology companies, emphasize questions 16-20 (technology infrastructure), unit economics, and competitive differentiation. For financial services and insurance, prioritize questions 21-25 (regulatory landscape), capital adequacy, and risk management culture.

Red Flag Recognition:

Pay attention to evasive answers, inconsistencies between different interviewers, reluctance to provide specific data or stakeholder introductions, and pressure to decide quickly without adequate due diligence time. These often indicate concealed problems that could significantly impact your success.

Decision Framework Integration:

Use responses to create weighted evaluation criteria based on your personal priorities - whether financial upside, cultural fit, learning opportunities, or risk tolerance. Model best-case, base-case, and worst-case scenarios for how the role might unfold, and ensure you can handle worst-case outcomes before accepting.

The goal is informed judgment that balances opportunity against risk while ensuring alignment with your long-term career objectives and personal values. Thorough due diligence at this level prevents career-limiting surprises and positions you for meaningful value creation in your new role.

FACEBOOK hired many legendary candidates with ONE simple question:

"If you were in my role, what would you focus on?"

This question was like a leadership X-ray machine. It revealed:

• Strategic thinking - Could they see the whole chessboard?

• Empathy - Did they understand multiple stakeholders?

• Ambition - Were they playing it safe or thinking big?

The average candidates gave textbook answers (yawn).

The great ones? They came armed with ideas that could transform the company.

The best answers shared 3 traits:

• Deep understanding of real challenges (not fluff)

• Scalable solutions (not band-aids)

• Clear mission alignment (not chasing metrics)

But here's the genius part most people miss. The question wasn't just about hiring - it revealed how candidates would approach leadership.

• Would they own problems or play the blame game?

• Could they turn big ideas into real action?

• Did they think in systems or quick fixes?

The best leaders don't just ask good questions.

They spot transformative changes before everyone else.

source: Baptiste Parravicini https://www.linkedin.com/feed/update/urn:li:activity:7275218480973377537/

50 questions and sample answers on BUSINESS TRANSFORMATION.

Candidates should provide realistic and thoughtful replies using the perspective of a seasoned digital transformation leader (e.g., Chief Digital Officer, Transformation Program Director, or Enterprise Architect) . Here's some examples..

🎯 STRATEGY & VISION

1. How do you define “digital transformation” in the context of a large enterprise?

ANSWER: Digital transformation in large enterprises isn’t just about adopting new tech — it’s the strategic realignment of people, processes, and platforms to drive customer value, operational agility, and innovation at scale. It means rethinking legacy operating models to compete in a digital-first economy — whether that’s through AI-driven decision-making, cloud-native architectures, or reimagined customer journeys.

2. What are the most common strategic mistakes large enterprises make when embarking on digital transformation?

ANSWER: Three big ones: (1) Treating it as an IT project instead of a business-wide initiative; (2) Lack of executive alignment — especially from the CEO and CFO; and (3) Trying to boil the ocean — launching too many pilots without a clear roadmap or prioritization framework. I’ve seen programs fail because they chased “shiny objects” without tying initiatives to measurable business outcomes.

3. How do you align digital transformation initiatives with overall business strategy and corporate objectives?

ANSWER: I start by mapping digital initiatives directly to the company’s strategic pillars — e.g., “Grow Market Share,” “Improve Operational Efficiency,” or “Enhance Customer Loyalty.” Each initiative must have a clear owner, KPI, and linkage to corporate OKRs. I also co-create roadmaps with business unit heads to ensure buy-in and relevance.

4. Can you describe how you’ve helped set a digital vision for a large organization? What was the outcome?

ANSWER: At a Fortune 500 retailer, I led a 6-month visioning process with the C-suite, including workshops, customer immersion sessions, and competitive benchmarking. We landed on “Frictionless Omnichannel Experiences Powered by AI.” This became our North Star — guiding $200M in tech investments over 3 years. Outcome: 30% increase in digital revenue, 25% reduction in fulfillment costs.

5. How do you prioritize digital initiatives when resources are limited?

ANSWER: I use a weighted scoring model based on: (1) Strategic alignment, (2) Customer impact, (3) ROI potential, (4) Feasibility, and (5) Risk. We also apply the “Now, Next, Later” framework. For example, we deprioritized a blockchain pilot to focus on core e-commerce modernization — which unlocked immediate revenue and funded future innovation.

👔 LEADERSHIP & GOVERNANCE

6. What role should the CEO and C-suite play in driving digital transformation?

ANSWER: The CEO must be the chief evangelist — publicly championing the vision, allocating budget, and holding leaders accountable. The CFO must reframe CapEx/OpEx models for digital investments. The COO must drive process redesign. Without active, visible C-suite sponsorship, transformation stalls.

7. How do you structure governance for enterprise-wide digital programs?

ANSWER: I establish a Digital Steering Committee with C-suite reps, business unit heads, and tech leads. We meet biweekly, track initiatives via a portfolio dashboard, and use stage-gate reviews. We also embed “Digital Champions” in each BU to ensure local ownership and escalation paths.

8. Describe a time you had to convince skeptical executives to invest in a digital initiative. How did you approach it?

ANSWER: At a manufacturing firm, the CFO resisted a $15M IoT investment. I built a business case showing 3-year payback via predictive maintenance savings and reduced downtime. I also ran a 90-day pilot in one plant — results showed 18% OEE improvement. That pilot became the proof point that unlocked enterprise funding.

9. How do you ensure accountability across departments during a multi-year transformation?

ANSWER: I embed digital KPIs into leaders’ performance scorecards. For example, “% of processes automated” or “NPS improvement from digital touchpoints.” We also hold quarterly “Transformation Reviews” where leaders present progress — creating peer pressure and transparency.

10. What’s your approach to building or restructuring a digital leadership team?

ANSWER: I look for T-shaped leaders: deep in one domain (e.g., data, CX, agile), but collaborative across functions. I blend internal talent (for institutional knowledge) with external hires (for fresh perspective). Critical roles: Chief Data Officer, VP of Digital Products, Agile COE Lead, and Change Management Director.

💻 TECHNOLOGY & ARCHITECTURE

11. What core technologies do you consider foundational for enterprise digital transformation today?

ANSWER: Cloud (AWS/Azure/GCP), APIs & microservices, data lakehouse architecture, low-code platforms, AI/ML ops, and cybersecurity mesh. But tech is only 30% — the rest is process and people.

12. How do you balance legacy system modernization with new digital platform adoption?

ANSWER: I use a “strangler pattern” — gradually replacing legacy components with modern microservices while maintaining business continuity. Example: We wrapped a 30-year-old mainframe with APIs to enable mobile apps, then incrementally migrated functions to cloud over 24 months.

13. What’s your view on cloud adoption (public, private, hybrid) in large enterprises? What challenges have you seen?

ANSWER: Hybrid is often the pragmatic path — especially for regulated industries. Biggest challenges: skills gap, data residency, and FinOps (cloud cost control). I’ve implemented Cloud Centers of Excellence to govern migration, security, and cost optimization.

14. How do you approach data architecture and integration in a siloed enterprise environment?

ANSWER: Start with a “data mesh” philosophy — domain-oriented, decentralized ownership with shared governance. We created a unified customer data platform (CDP) that ingested data from 12 siloed systems using event streaming (Kafka) and master data management (MDM).

15. What role does AI/ML play in your digital transformation roadmap? Can you give an example?

ANSWER: AI is an accelerant — not a silver bullet. We used ML for dynamic pricing in retail (5% revenue lift) and predictive churn in telecom (15% reduction in attrition). Key: Start with high-impact, data-rich use cases — not “AI for AI’s sake.”

🧑💻 CUSTOMER & EXPERIENCE FOCUS

16. How do you embed customer-centricity into enterprise digital initiatives?

ANSWER: I mandate “Voice of Customer” integration in every initiative — via journey mapping, NPS feedback loops, and co-design sessions. We also created a “Customer Impact Score” as a gating criterion for funding.

17. Describe how you’ve used customer journey mapping to drive digital improvements.

ANSWER: We mapped the end-to-end B2B procurement journey for a logistics client. Found 14 pain points — e.g., manual PO approvals. Redesigned the workflow with RPA and self-service portal. Result: 40% faster order processing, CSAT up 35 points.

18. What metrics do you track to measure improvement in customer experience post-transformation?

ANSWER: Beyond NPS: CES (Customer Effort Score), task completion rate, retention/churn, lifetime value, and digital engagement depth (e.g., feature adoption). We tie these to revenue — e.g., customers with low CES spend 2.3x more.

19. How do you reconcile enterprise-scale processes with personalized digital experiences?

ANSWER: Use segmentation + real-time decision engines. Example: We deployed a CDP + recommendation engine that served personalized content to 5M+ users while running on shared enterprise infrastructure. Scale through modular architecture; personalize through data + AI.

20. What’s your approach to digital channel strategy (mobile, web, IoT, etc.) for B2B vs. B2C enterprises?

ANSWER: B2B: Focus on workflow integration, API ecosystems, and admin efficiency (e.g., Salesforce, SAP integrations). B2C: Prioritize mobile-first, personalization, social commerce. But both need unified data and omnichannel consistency.

🔄 CULTURE & CHANGE MANAGEMENT

21. How do you foster a digital-first culture in a traditional, hierarchical enterprise?

ANSWER: Lead by example — executives must use digital tools publicly. Launch “Digital Ambassador” programs. Celebrate small wins. We ran “Fail Forward Fridays” to destigmatize experimentation. Culture eats strategy for breakfast — you must feed it daily.

22. What’s your change management framework for large-scale digital initiatives?

ANSWER: I blend Prosci ADKAR with agile change. Key steps: (1) Build coalition of sponsors, (2) Define “What’s in it for me?” per role, (3) Train-the-trainer cascades, (4) Feedback loops, (5) Reinforce through recognition and metrics.

23. How do you handle resistance from middle management or long-tenured employees?

ANSWER: Listen first — often resistance is fear of obsolescence. I co-create transition plans, offer upskilling paths (e.g., “Automation Academies”), and involve resistors in design. One plant manager became our biggest RPA champion after we showed how it freed his team for higher-value work.

24. Describe a time you successfully shifted organizational mindset toward agility and experimentation.

ANSWER: We launched “10% Time” — allowing teams to spend 10% of their week on innovation. Funded top ideas via Shark Tank-style pitches. One team’s chatbot prototype became our enterprise virtual assistant — now handling 50K+ queries/month.

25. How do you encourage innovation and intrapreneurship at scale?

ANSWER: Create “Innovation Garages” — safe spaces with budget, mentorship, and rapid prototyping tools. We also tied 15% of bonus to innovation KPIs (e.g., patents filed, ideas implemented). Celebrated “Innovator of the Quarter” company-wide.

🚀 AGILITY, OPERATING MODELS & WAYS OF WORKING

26. How do you introduce agile or DevOps practices in a non-tech enterprise?

ANSWER: Start small — pilot with one product team. Use “Agile in a Box” toolkits. Train product owners, not just developers. We embedded Scrum Masters in marketing and finance — now 70% of non-tech teams use agile rituals for project work.

27. What operating model changes are necessary to sustain digital transformation?

ANSWER: Shift from siloed functions to cross-functional product teams. Implement product-line P&Ls. Decentralize budgeting. Adopt continuous delivery. We moved from annual planning to quarterly “Portfolio Sprints” with dynamic funding.

28. How do you manage the tension between speed (agile) and governance (enterprise controls)?

ANSWER: Automate compliance — e.g., embed security scans in CI/CD pipelines. Create “guardrails, not gates.” We defined “Minimum Viable Compliance” checklists that teams self-certify — reducing approval cycles from 4 weeks to 2 days.

29. What’s your experience with setting up digital factories, pods, or squads in large orgs?

ANSWER: I stood up a 150-person Digital Factory for a bank — organized into 12 cross-functional squads (UX, dev, data, ops). Used SAFe for alignment, but empowered squads to choose their methods. Delivered 3x faster time-to-market.

30. How do you scale pilot projects into enterprise-wide programs?

ANSWER: Bake scalability into pilot design from Day 1 — use enterprise-grade tech, document processes, train “scale champions.” We piloted RPA in AP, then created a Center of Excellence that scaled to 500+ bots across 8 countries in 18 months.

🤝 PARTNERSHIPS, ECOSYSTEMS & INNOVATION

31. When should an enterprise build vs. buy vs. partner for digital capabilities?

ANSWER: Build: Core IP or competitive differentiators (e.g., proprietary algorithms). Buy: Commodity capabilities (e.g., CRM, HRIS). Partner: When you need speed or niche expertise (e.g., AI startups, cloud hyperscalers). Always assess total cost of ownership.

32. How do you evaluate and onboard technology partners or startups in a risk-averse enterprise?

ANSWER: Use a “sandbox” approach — limited-scope pilots with clear exit clauses. Assess: security posture, scalability, cultural fit, and support model. We created a “Startup Fast Track” with legal and procurement to cut onboarding from 6 months to 6 weeks.

33. Describe your experience managing vendor ecosystems or platform partnerships.

ANSWER: I managed a Salesforce ecosystem of 12 implementation partners. Created a Partner Governance Board, standardized SLAs, and quarterly innovation days. Reduced integration costs by 30% through reusable connectors.

34. How do you leverage open innovation or co-creation with customers or partners?

ANSWER: Ran “Co-Innovation Labs” with top 20 customers — jointly prototyping features. One logistics client’s idea became our flagship tracking portal — now used by 80% of customers. Shared IP and revenue — win-win.

35. What’s your view on innovation labs or digital incubators — do they work at enterprise scale?

ANSWER: Only if tightly coupled to core business. “Skunkworks” labs often die in isolation. I restructured ours into “Embedded Innovation Teams” — each aligned to a business unit with joint KPIs. Doubled idea-to-production rate.

🛡️ RISK, SECURITY & COMPLIANCE

36. How do you embed cybersecurity and data privacy into digital transformation from day one?

ANSWER: “Shift Left” security — involve CISO in design sprints. Automate compliance checks. We implemented Zero Trust Architecture for all new digital products. Privacy by design: data minimization, consent workflows, and anonymization baked into pipelines.

37. What are the biggest regulatory or compliance risks in enterprise digital programs?

ANSWER: GDPR/CCPA violations, AI bias, third-party risk, and legacy tech non-compliance. Mitigation: Cross-functional compliance reviews, algorithmic impact assessments, and continuous monitoring. We avoided a $2M GDPR fine by catching a data leak in UAT.

38. How do you manage technical debt while accelerating transformation?

ANSWER: Allocate 20% of dev capacity to “debt sprints.” Track debt via a “Tech Health Dashboard.” We retired 3 legacy systems by funding modernization through savings from cloud migration — turning debt reduction into a self-funding loop.

39. Describe how you’ve handled a major digital initiative that posed significant operational risk.

ANSWER: Core banking system migration for a regional bank. Mitigation: Parallel run for 90 days, rollback playbook, 24/7 war room, and phased cutover by branch cluster. Zero downtime. Key: Over-communicate, over-test, over-prepare.

40. How do you ensure resilience and business continuity during large-scale digital change?

ANSWER: “Assume failure” mindset — design for rollback, redundancy, and graceful degradation. We ran Chaos Engineering drills pre-launch. Also, maintain legacy fallbacks until new systems prove stable — e.g., kept old IVR running alongside new voice AI for 6 months.

📊 METRICS, ROI & VALUE REALIZATION

41. What KPIs or OKRs do you use to measure digital transformation success?

ANSWER: Business: Revenue from digital channels, cost per transaction, customer retention. Tech: Deployment frequency, lead time, system uptime. People: Digital skills coverage, employee NPS. All tied to quarterly OKRs.

42. How do you quantify ROI for initiatives that are more strategic than transactional?

ANSWER: Use proxy metrics — e.g., “% of execs using data dashboards” for culture change, or “time-to-insight” for analytics. For innovation: track pipeline value (e.g., $50M in identified opportunities from AI ideation sessions).

43. Describe a digital initiative where you tracked and delivered measurable business value.

ANSWER: Implemented AI-powered supply chain forecasting for a CPG company. Reduced inventory carrying costs by 18% ($12M annual savings) and improved in-stock rate by 11 points. Tracked via integrated finance/ops dashboard.

44. How do you avoid “vanity metrics” and focus on outcomes that matter to the business?

ANSWER: Ask: “So what?” for every metric. E.g., “100K app downloads” → “So what? → 15% converted to buyers → $2.3M revenue.” We banned metrics without a clear business outcome linkage in steering committees.

45. What’s your approach to benefits realization management over a 3–5 year horizon?

ANSWER: Assign “Benefit Owners” for each initiative. Track leading and lagging indicators. Quarterly reviews with Finance. We created a “Value Tracker” dashboard showing cumulative ROI — kept leadership invested through multi-year programs.

🧭 REAL-WORLD EXPERIENCE & LESSONS LEARNED

46. Walk me through the largest digital transformation you’ve led or significantly influenced. What worked? What didn’t?

ANSWER: Led a 3-year, $300M transformation for a global insurer: modernized core systems, launched digital claims, upskilled 5K employees. Worked: Strong CEO sponsorship, agile pods, customer co-design. Didn’t: Underestimated change fatigue — should’ve paced releases better. Lesson: Transformation is a marathon — build rest stops.

47. What’s the most difficult stakeholder challenge you’ve faced — and how did you resolve it?

ANSWER: CIO resisted moving off mainframe due to “stability concerns.” I didn’t argue tech — I showed customer churn data linked to slow claims processing. Then ran a side-by-side pilot. Results convinced him. Lesson: Speak the stakeholder’s language — finance, risk, or customer — not tech.

48. Share an example of a digital initiative that failed. What did you learn?

ANSWER: An example: Launched a blockchain-based supplier ledger — too complex, no ROI. Killed it after 6 months. Learned: Start with problem, not tech. Now we require “Problem Statements” before any tech selection. Failure rate dropped 60%.

49. How do you keep momentum going after the “first wave” of transformation?

ANSWER: Declare “Waves, Not Projects.” After Wave 1 (foundations), launch Wave 2 (AI/automation), then Wave 3 (ecosystem innovation). Celebrate milestones, rotate champions, refresh vision. We held annual “Digital Festivals” to showcase wins and recruit new advocates.

50. If you were brought in tomorrow to lead digital transformation at our enterprise, what would be your first 90-day plan?

ANSWER:

Days 1–30: Listen — interview 50+ stakeholders, review strategy docs, assess tech debt.

Days 31–60: Co-create 100-day wins + 3-year roadmap. Secure quick wins (e.g., automate 3 manual reports).

Days 61–90: Stand up governance, launch 2 pilot squads, communicate vision company-wide.

Overall Goals: Build credibility, momentum, and alignment — not perfection.

✅ Final Note: These sample answers are designed to demonstrate strategic thinking, execution rigor, leadership presence, and lessons from real experience. In interviews, candidates should tailor responses to their background by giving specific project experience and work achievements — because authenticity matters more than memorized answers.

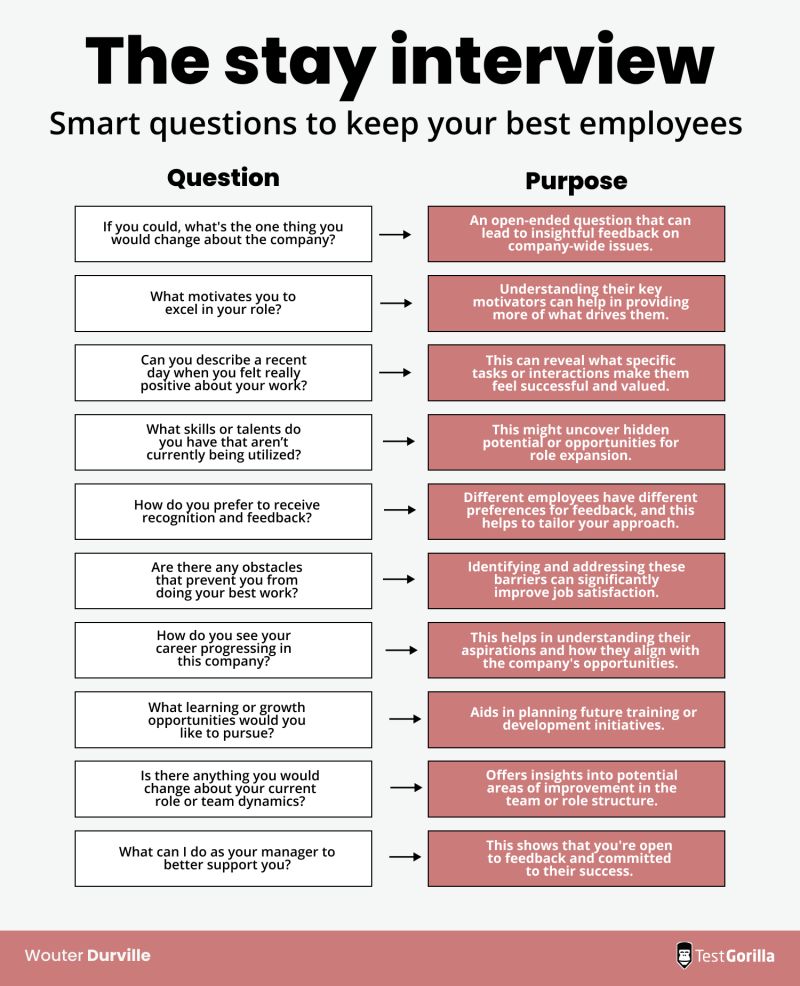

Are you doing Stay Interviews?

Are you doing Stay Interviews?

Stay interviews are one-on-one conversations between a manager and their direct reports, conducted while the employee is still employed, to understand their job satisfaction and identify what motivates them to stay with the company.

1. Positive Aspects and Engagement:

- What aspects of your role make you feel motivated and engaged?

- What do you find most rewarding about your work?

2. Areas for Improvement and Challenges:

- What could be improved to make your work experience better?

- When was the last time you considered leaving, and what prompted it?

- What one thing would you change about your role or the company?

3. Career Development and Growth:

- What are your career goals, and how does your current role help you achieve them?

- What opportunities are you interested in exploring to further your professional development?

4. Work Environment and Relationships:

- How would you describe the work culture at the company?

- How could the management team better support you?

5. Open-Ended and General Questions:

- What are you optimistic about in the next 6 months?

- What knowledge, experience, and skills would you enjoy sharing with colleagues?

- What are your preferred methods of receiving feedback?

source: https://www.linkedin.com/posts/wouter-durville_ever-heard-of-stay-interviews-if-not-youre-activity-7155918910624526336-z6rr/

Key Skills Employers Look for in Sales Candidates

When hiring sales candidates, employers are looking beyond personality and persuasive skills; they want professionals who contribute directly to the business's growth and long-term success. Sales KPIs are often defined by measurable results like revenue, client acquisition, and market penetration. Here are the core skills that define top-performing sales professionals and how they connect to KPIs and business solutions.

1. Goal Orientation and KPI Mastery

- Why It Matters: Sales is a target-driven role, and goal-oriented professionals are committed to meeting and exceeding defined KPIs, like monthly revenue targets, lead conversion rates, and customer retention figures. Employers prioritize candidates who demonstrate consistent performance and improvement.

- What Employers Look For: Candidates should show a proven record of meeting KPIs, preferably with tangible results. They should be able to analyze their past achievements, identify areas for growth, and align their goals with the company’s broader revenue objectives.

2. Customer-Centric Problem Solving

- Why It Matters: Understanding customer pain points and responding with tailored solutions is essential in today’s customer-driven markets. Sales candidates must approach each interaction as an opportunity to provide genuine value, which increases satisfaction and drives repeat business.

- What Employers Look For: Candidates should show an ability to ask insightful questions, identify underlying customer needs, and adapt solutions accordingly. Sales professionals who actively listen to customers can often help shape product solutions, offering feedback that strengthens the company’s product-market fit.

3. Market and Product Knowledge

- Why It Matters: Sales professionals are not just selling products; they are building trust and credibility by demonstrating expertise in the product and the industry. Comprehensive knowledge of the company's offerings and competitive landscape allows sales teams to position solutions that resonate with clients.

- What Employers Look For: Employers seek candidates who come prepared with a solid understanding of the market dynamics and can speak to the unique benefits of their product. Salespeople with a high degree of market knowledge can engage more deeply with clients, anticipate objections, and drive solutions that competitors might overlook.

4. Adaptability and Tech Proficiency

- Why It Matters: With technological advancements, sales platforms, CRM systems, and AI-driven tools are essential for managing customer relationships and forecasting sales trends. Sales professionals who can harness these tools can streamline processes, identify trends, and provide data-backed insights.

- What Employers Look For: Employers value candidates who are comfortable using CRM software, analytics platforms, and other sales technology. These tools are fundamental for tracking client engagement, managing pipelines, and enhancing conversion rates—essential KPIs that translate into business growth.

5. Communication and Relationship-Building Skills

- Why It Matters: Strong communicators establish lasting relationships with clients, influencing brand loyalty and increasing client lifetime value. A candidate’s ability to communicate clearly, build rapport, and convey solutions effectively is crucial for sustained business.

- What Employers Look For: The most successful salespeople are relationship-driven. They follow up with leads, maintain consistent communication, and develop trust. Candidates with high emotional intelligence (EQ) and interpersonal skills are adept at reading situations, adjusting their approach, and enhancing client engagement.

6. Strategic Planning and Time Management

- Why It Matters: Sales professionals who prioritize activities effectively contribute to reaching quarterly or annual sales targets without sacrificing quality. Strategic planning also allows sales teams to focus on high-potential clients, leading to more efficient use of resources and improved conversion rates.

- What Employers Look For: Employers seek candidates who exhibit strong organizational skills and an ability to prioritize tasks based on their impact on business KPIs. A candidate who can manage multiple clients, accurately project timelines, and achieve individual and team goals is highly valuable to growth-focused businesses.

Measuring KPIs for Sales Effectiveness

To maximize the effectiveness of sales hires, businesses track several KPIs that align with these skills:

1. Revenue Growth – Measures how effectively the salesperson drives revenue over time.

2. Conversion Rate – The percentage of leads converted to sales, reflecting a candidate’s ability to engage and close deals.

3. Customer Acquisition Cost (CAC) – Helps assess the efficiency of resources invested in acquiring new clients.

4. Client Retention Rate – Indicates a salesperson's ability to build long-term relationships.

5. Sales Cycle Length – Shorter cycles generally reflect a sales professional's skill in guiding clients toward purchase decisions efficiently.

Hiring sales candidates with these key skills helps companies ensure that each new hire will contribute meaningfully to growth and market success. By balancing the ability to connect with customers and solve their problems with technology proficiency and KPI-driven performance, a business builds a sales team equipped to navigate today’s dynamic market challenges.